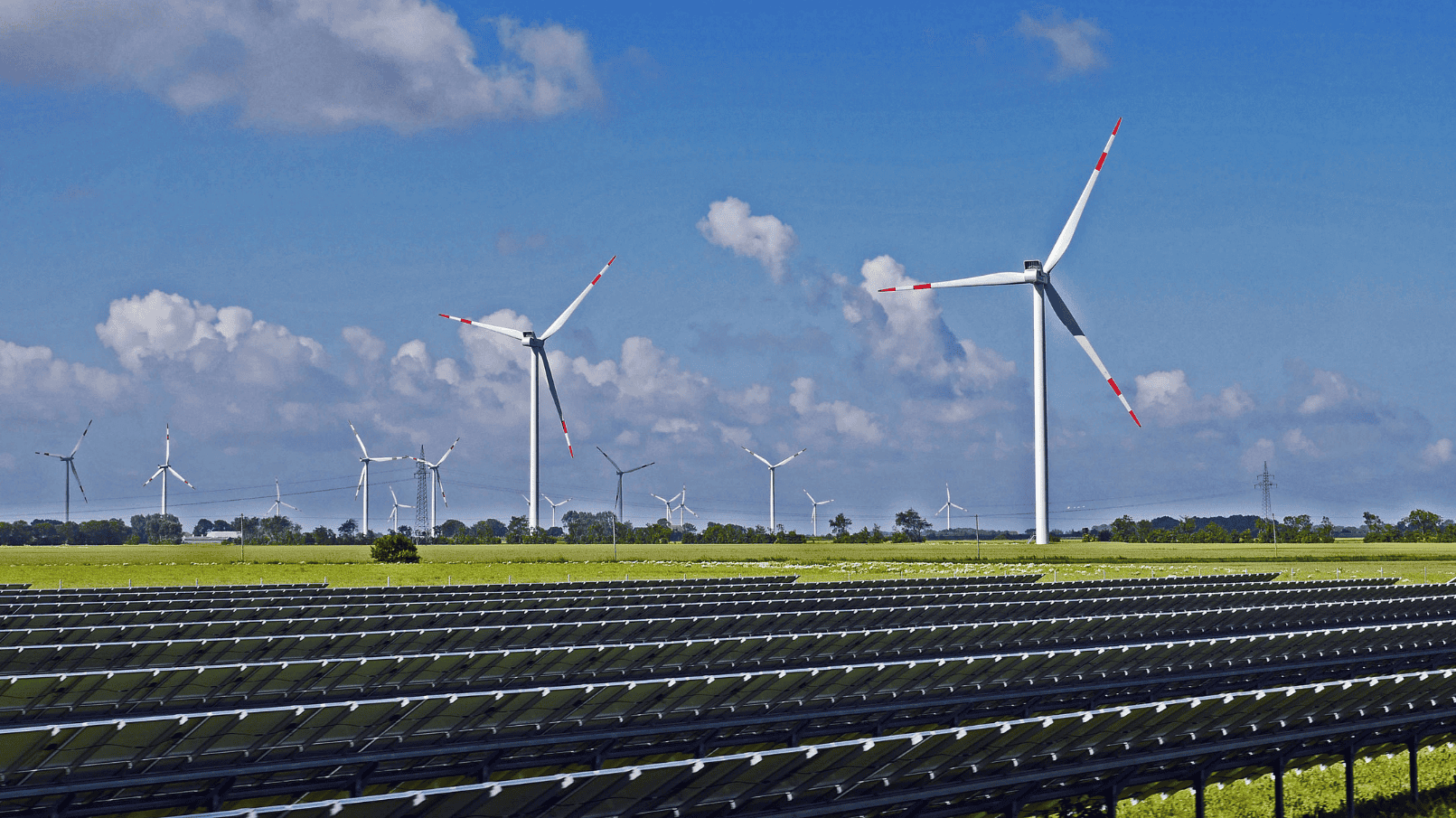

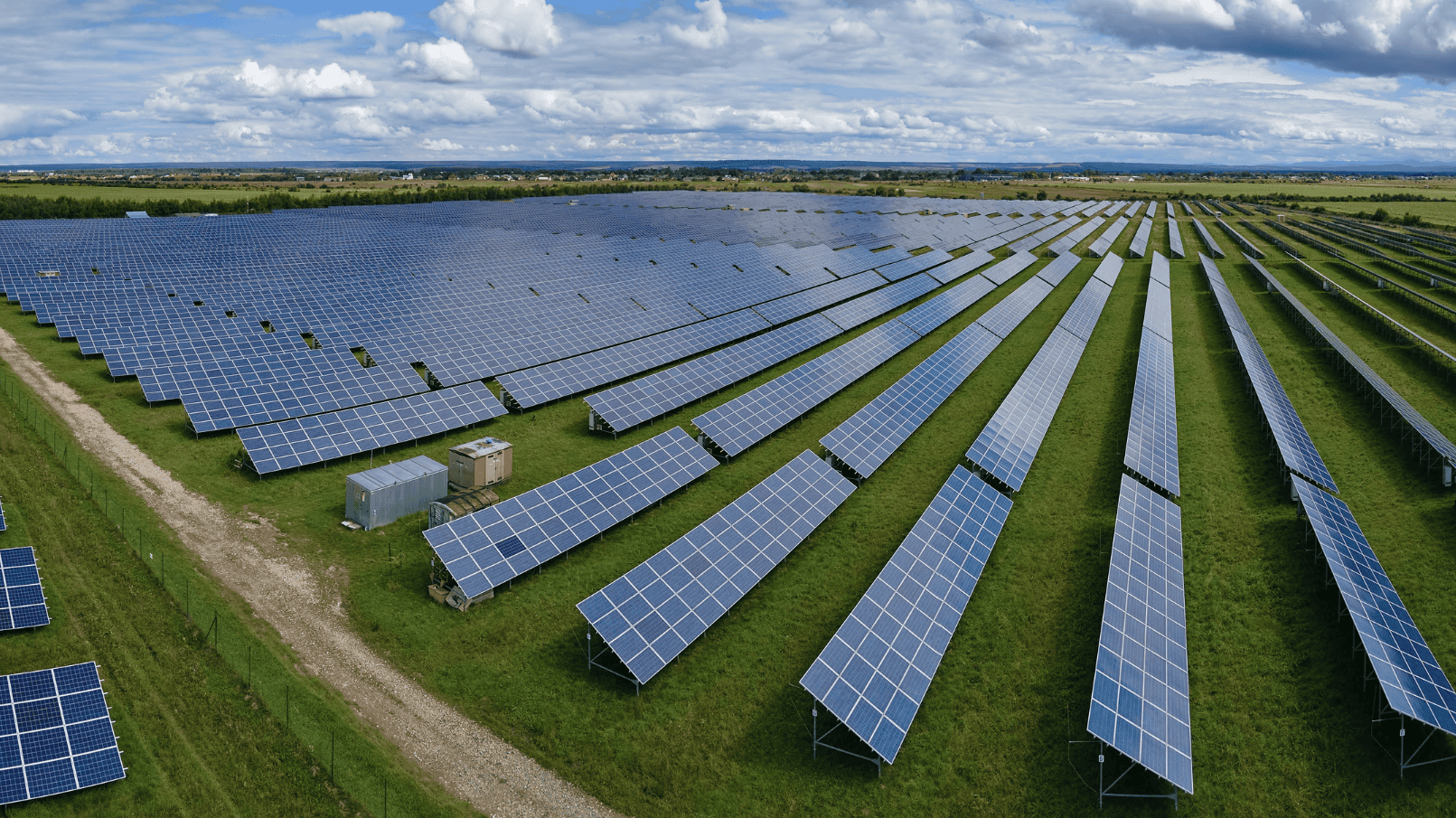

As the demand for renewable energy grows and the U.S. continues to transition its electrical system to clean-generating assets, solar farms and community solar have emerged as key opportunities. There are many new opportunities for land owners and solar developers with renewable energy and solar growth into the future. Understanding the costs of solar projects, however, is essential for any market participants looking to invest in solar.

This article outlines the factors that influence the cost of solar development, detailing potential revenue forecasts, and strategies for maximizing the value of a renewable energy project.

The Costs Of Solar

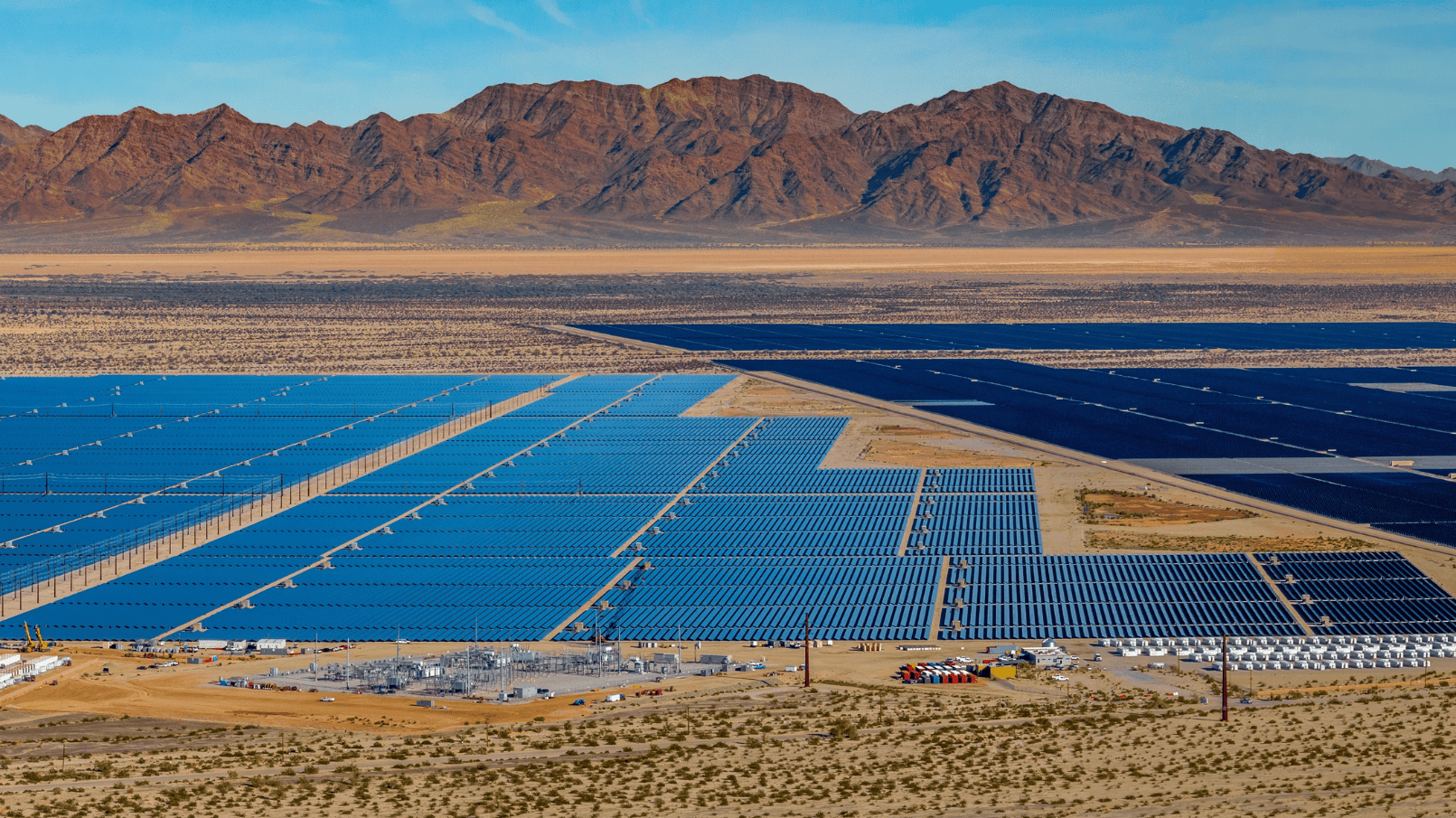

Solar development, whether it be a commercial system tied to a power purchase agreement, a community solar project using a VPPA, or a utility-scale project, requires significant capital investment. The total cost of a solar project depends on a variety of factors including, the size of the system, the types of solar panels being used, the complexity of the engineering design, and finally, the cost of land needed to construct a large-scale project. Here is an outline of some of the average costs of a solar project in 2025:

- Land Cost: Between $1,000 to $5,000 per acre per year for a solar land lease

- Equipment Cost: The cost of equipment, such as solar panels, inverters, mounting, and racking, equates to approximately 75% of the total project cost.

- Engineering, Permitting, and Applications: Roughly 5% of the project costs should be allocated for engineering, permitting, and interconnection applications.

- Installation Cost: Your installation and labor costs should equate to approximately 20% of your total project cost.

Here is an example of the cost breakdown of a 5 MW solar farm:

| Item | Total cost | Cost per watt | % of project |

| Equipment | $9.3 million | $1.86 | 74% |

| Labor | $2.5 million | $0.50 | 20% |

| Engineering | $500,000 | $0.10 | 4% |

| Permitting | $200,000 | $0.04 | 2% |

| Total | $12.5 million | $2.50 | 100% |

*Chart is for example purposes only. Actual solar development numbers are subject to sun exposure, proximity to three-phase power, material costs, and other factors.

Why Invest In Solar?

Solar farms offer a host of benefits for investors and landowners alike. In addition to significant financial rewards, they contribute to the global push for decarbonization and provide communities with access to clean energy. Some of the major benefits of investing in solar include:

Long-Term Revenue Generation

First and foremost, solar investment provides a long-term revenue stream for solar asset owners, solar investors, and solar developers alike. Large-scale solar farms are able to generate electricity for a period of 20-30 years, and that electricity is often sold into the wholesale electricity market, directly to end-users through community solar legislation, or to a single off-taker utilizing a virtual power purchase agreement (VPPA). These investments provide an attractive rate of return on capital and allow investors to secure long-term income.

Tax Benefits

There are also many tax benefits associated with investing in solar projects. The federal government currently offers a 30% investment tax credit on all new solar developments that can be directly applied in a one-to-one correlation against any tax obligations for the solar project owners. This makes investing in solar very attractive for high-net-worth individuals who are looking to offset capital gains or other income tax.

Alternative Investments

Solar investing provides a great alternative investment opportunity outside of traditional stock, bond, and mutual fund investments. Intelligent investors are always looking for ways to diversify their portfolios to eliminate the risk of being over-invested in a single asset class. Solar is quickly becoming an alternative investment vehicle for many investors and financial institutions.

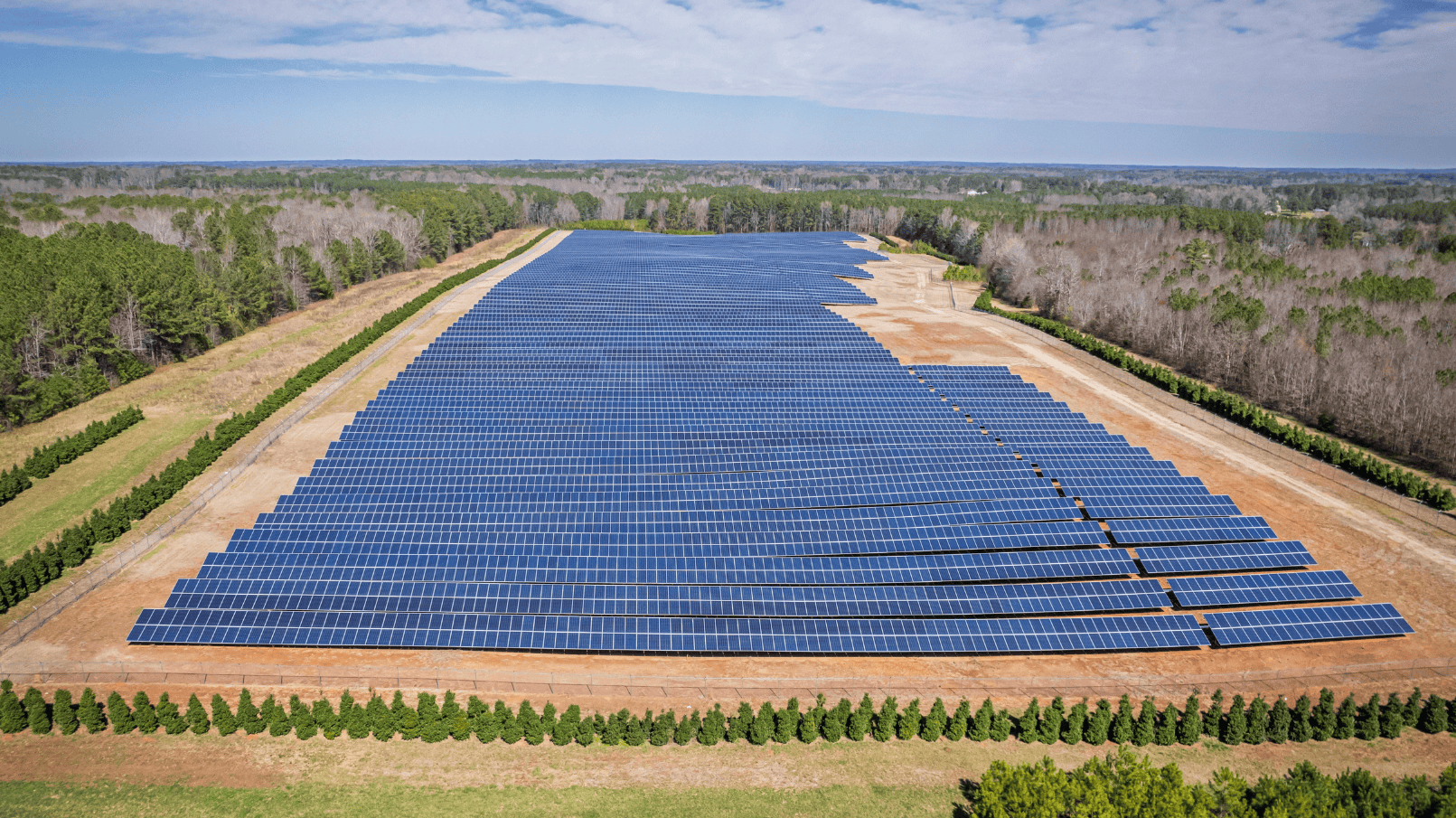

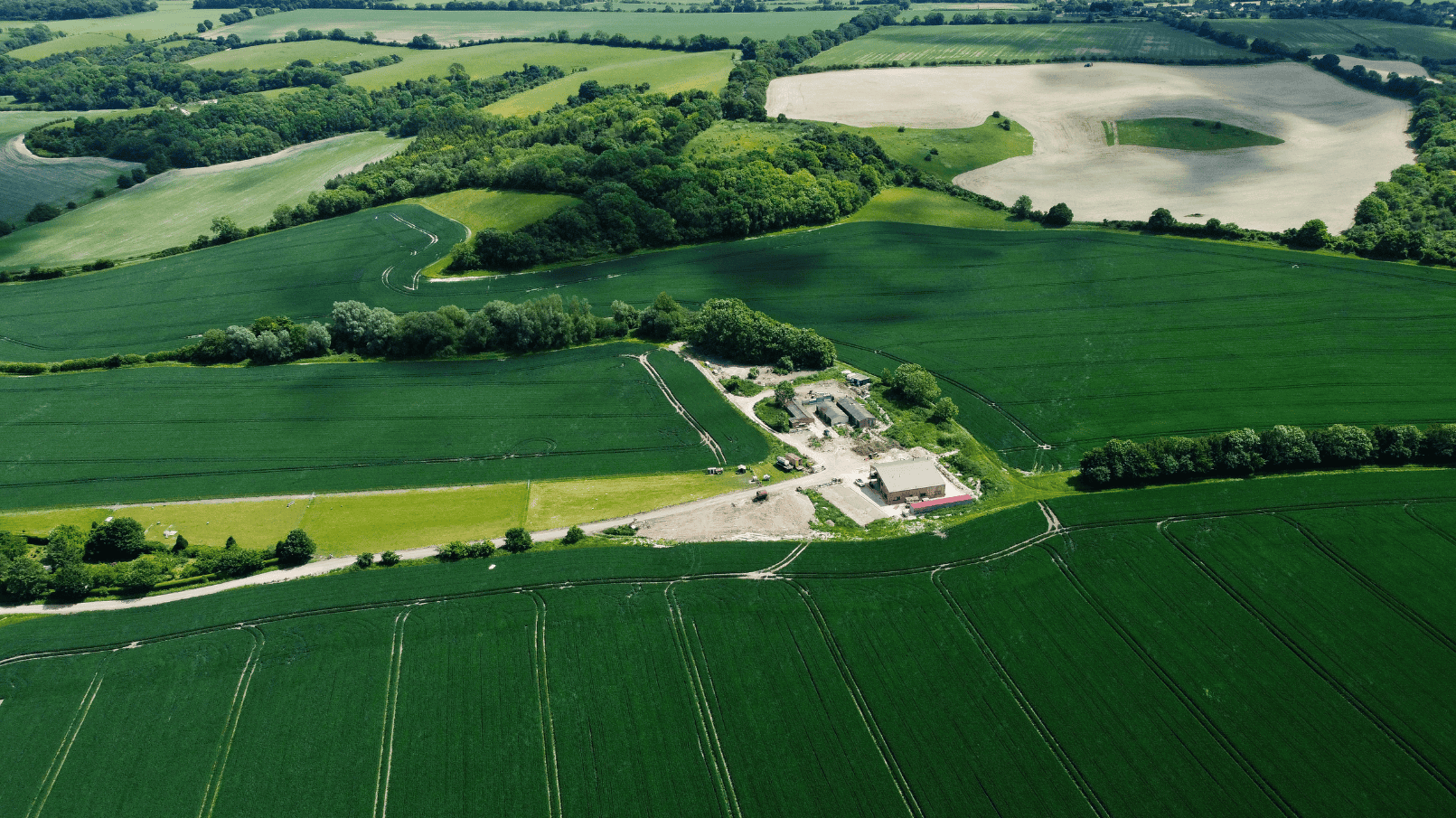

Maximize Value Of Underutilized Land

For landowners looking to maximize the value of their land, solar developments are a great opportunity. Solar developers are actively seeking unused land for solar projects and are willing to pay thousands of dollars per acre per year on long-term solar land leases. This is a mutually beneficial agreement between the developer and landowner as it allows both parties to benefit from new solar technologies.

Assessing Solar Investment ROI

Investing in a solar farm is a long-term commitment, and understanding the potential ROI is critical for renewable energy investors. ROI for solar farms typically depends on several factors:

- System Size and Energy Production: Larger systems generate more energy, increasing revenue from electricity sales. Developers, however, must be aware of local grid infrastructure and needs as certain system operators have Do Not Exceed (DNE) limits or curtailment orders that can impact the total output of a solar system. A detailed analysis of these constraints must be performed in order to size the system properly and avoid losses from solar clipping.

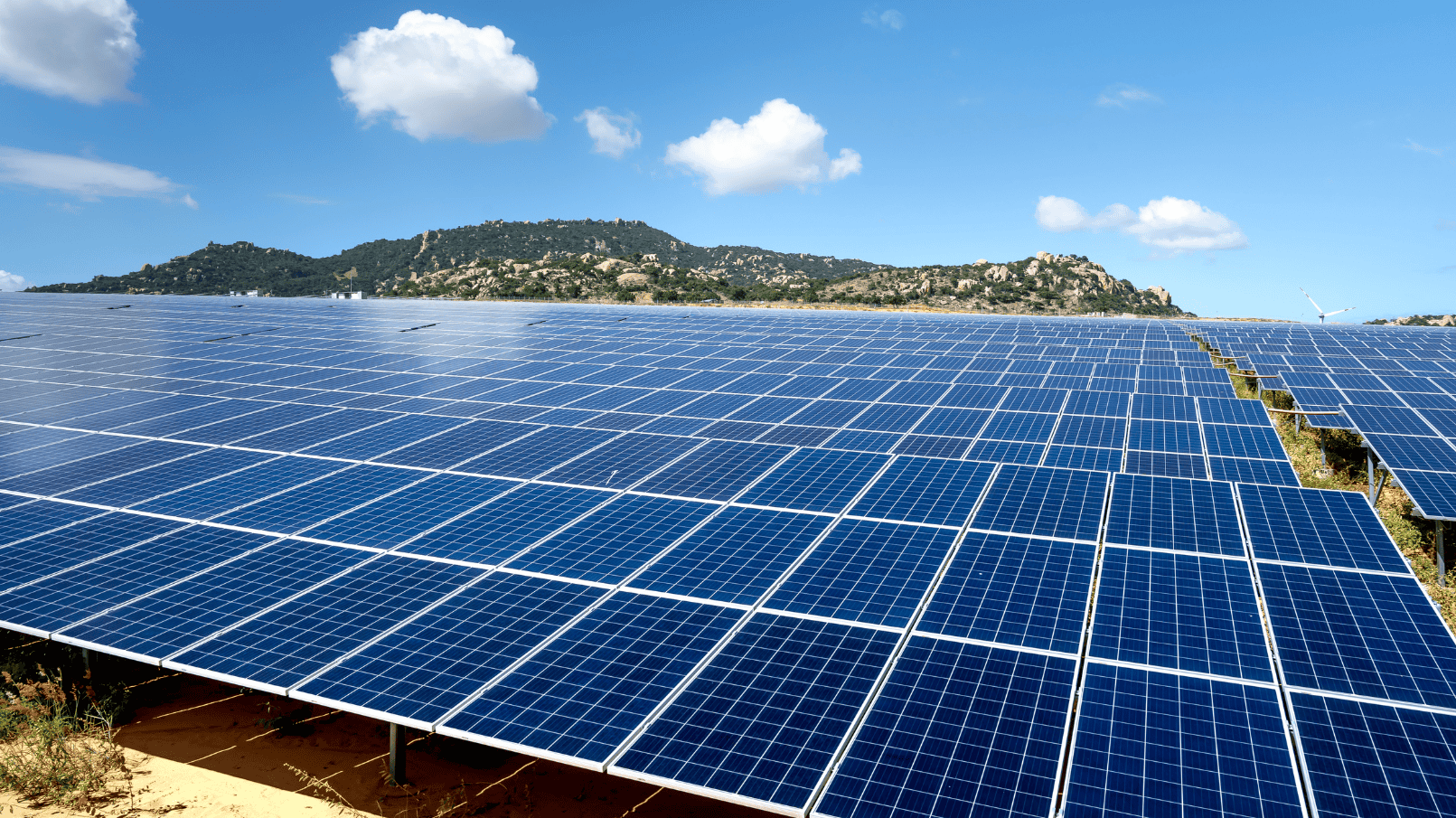

- Geographic Location: Areas with high sun exposure and favorable energy markets yield higher returns. Certain utilities or grid operators have more of an appetite for solar production. It is imperative to perform a market analysis prior to investing in any solar development.

- Energy Offtake Agreements: Power purchase agreements (PPAs) and community solar subscriptions ensure predictable income streams by locking in energy buyers at pre-negotiated rates. Oftentimes, these agreements are critical for project funding as project capitalization is difficult without some sort of guaranteed revenue steam.

The payback period for solar farms often ranges from 7 to 12 years, depending on installation costs, energy rates, and incentives. After this period, the majority of the energy generated becomes profit for the landowner or investor, with minimal costs for system maintenance and operation.

Maximizing Your Solar Investments

To maximize the value of your solar investment, consider the following strategies:

- Choose High-Efficiency Technology: Invest in advanced solar panels and inverters to optimize energy production and improve long-term performance. There are many different types of solar panels available on the market today. Monocrystalline panels are the most expensive, but also produce the highest energy output and efficiency, while polycrystalline panels are the least expensive, but also have the lowest energy output.

- Leverage Government Incentives: Take full advantage of tax credits, grants, and RECs to reduce upfront costs and enhance profitability. In addition to the standard 30% federal tax credit, there are several additional incentives such as the REAP grant, if solar projects are constructed in rural communities.

- Work With Reputable Developers: Partner with experienced solar developers who understand the complexities of interconnection, permitting, and energy markets. This will help to improve project timelines and minimize any carrying cost of debt used to finance the project.

- Diversify Revenue Streams: Explore opportunities like energy storage, ancillary services, and PPAs to maximize earnings. While most energy production from a solar farm should be earmarked for an off-taker agreement, there are other wholesale market opportunities to consider for additional energy output. These revenue streams can help to improve overall project ROI.

Ready To Explore Solar Investing?

If you’re ready to explore the income potential of developing a solar project in your community or leasing your land for a solar farm, Genie Solar Energy is here to help. Contact our team today for a free land consultation or project evaluation and discover how we can turn your property into a reliable source of revenue while contributing to a sustainable energy future.