The demand for solar energy is rising as businesses, utilities, and communities transition toward renewable energy. This shift presents a lucrative opportunity for landowners, developers, and investors looking to invest in solar power through solar land leasing or direct solar project development. Not all solar investments are created equal, however. This article explores what makes for a good solar investment, how landowners can maximize land value for solar farms, and the potential pitfalls to avoid when considering an investment in solar energy.

Why Invest In Solar?

Investing in solar power offers multiple benefits, including financial stability, tax incentives, and environmental impact. Here’s why landowners and investors are turning to solar:

Steady Revenue Streams

Landowners can lease land for solar to developers, generating long-term, stable income without upfront capital investment. Lease payments typically range from $1,000 to $5,000 per acre annually, depending on an array of factors such as location, land quality, and access to three-phase power. Solar asset owners, on the other hand, are generating long-term, recurring revenue by selling energy production from solar farms into community solar programs or directly to off-takers through virtual power purchase agreements.

Tax Incentives

Programs like the federal investment tax credit offer significant incentives for solar panel installations. This tax program allows investors to earn a 30% tax credit for the entire value of a solar project. For high-net-worth investors, this presents an opportunity to offset other tax liabilities while investing in a cash-flowing asset.

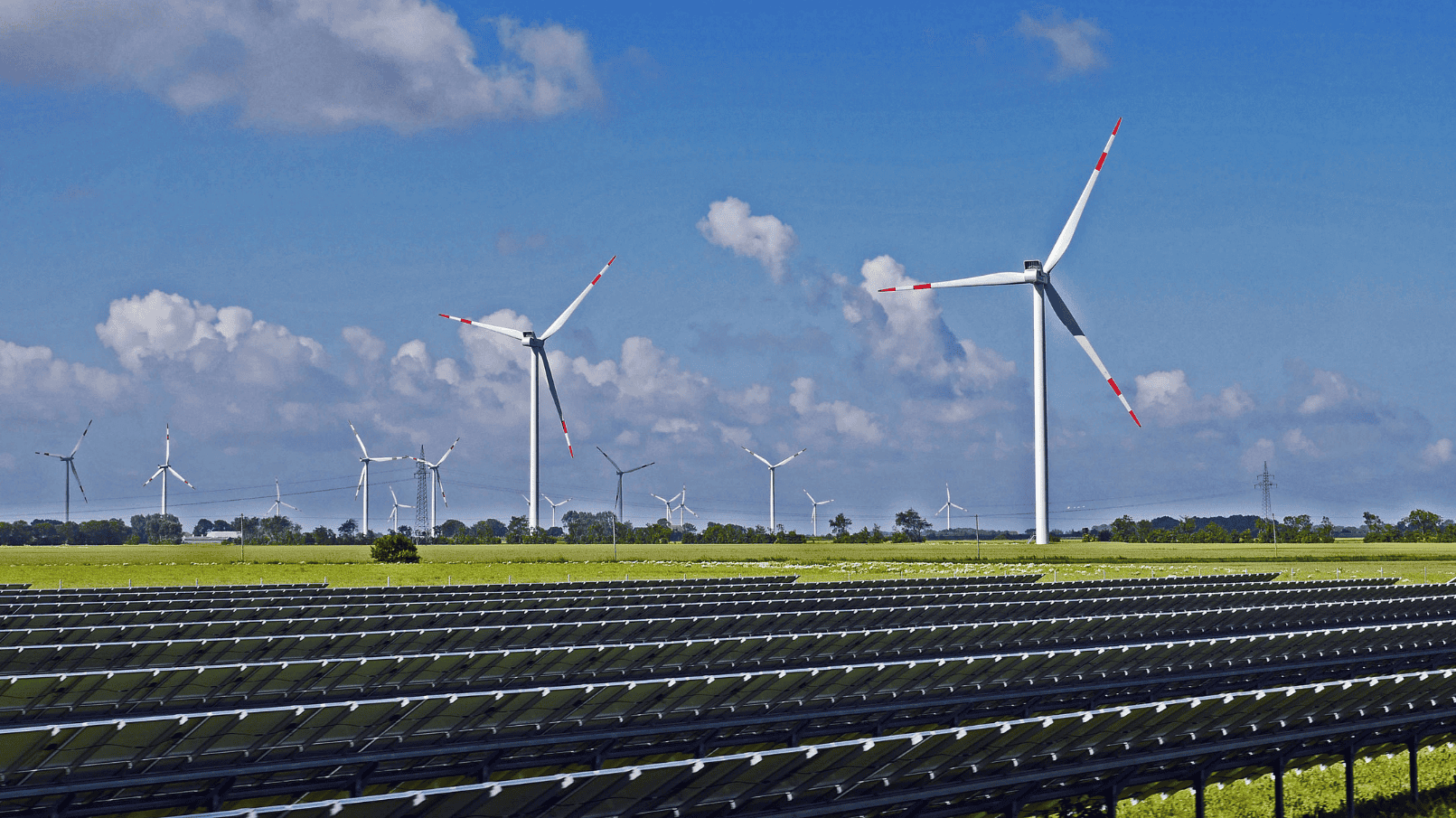

Growing Demand

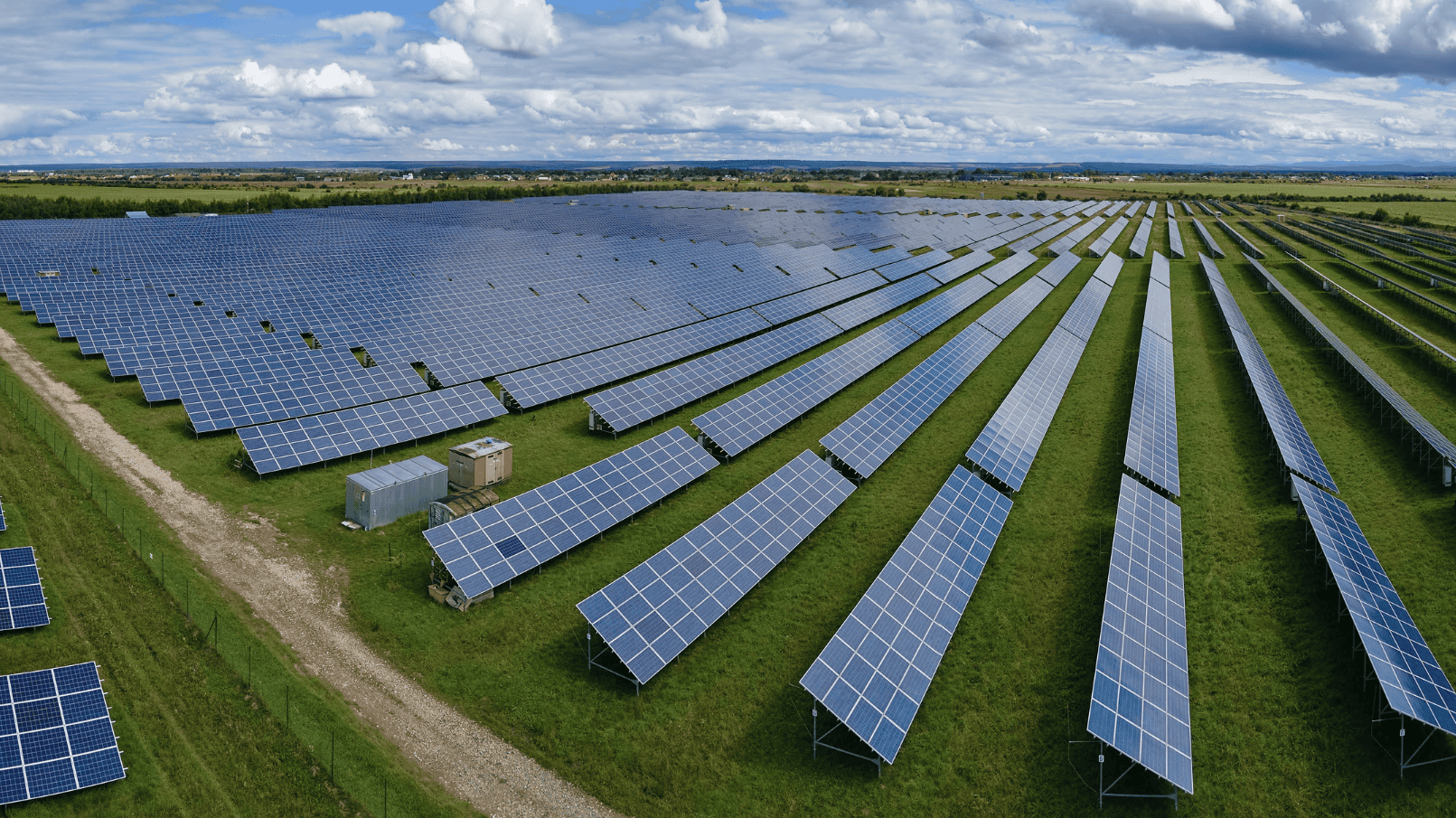

States and utility companies are aggressively expanding their solar energy systems in order to meet federal regulations, increase energy production capacity, and contribute to environmental concerns. This trend is driving new demand for solar opportunities around the country, from leasing land to building projects for utility community solar initiatives.

Minimal Involvement

For landowners looking to take advantage of renewable energy opportunities, they can generate truly passive income by providing space for solar development. Other solar developers offer silent investment opportunities as well for those looking to participate in building large-scale systems.

What Makes For A Good Solar Investment?

Solar can be a lucrative investment if planned correctly. Like any real estate or energy project, an investment in solar energy depends on multiple factors, including land suitability, market conditions, and regulatory hurdles. Here are some considerations for a good solar investment:

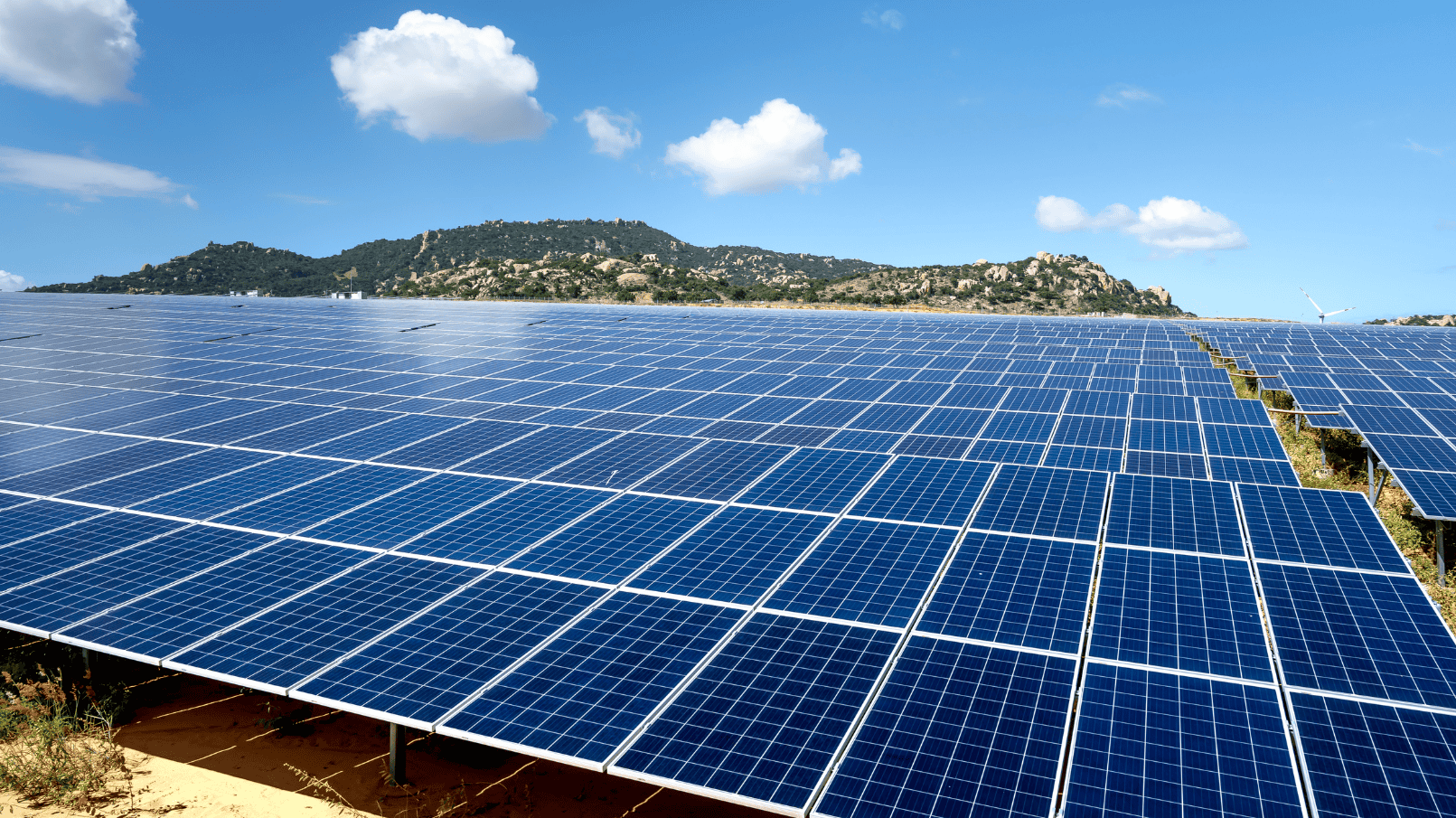

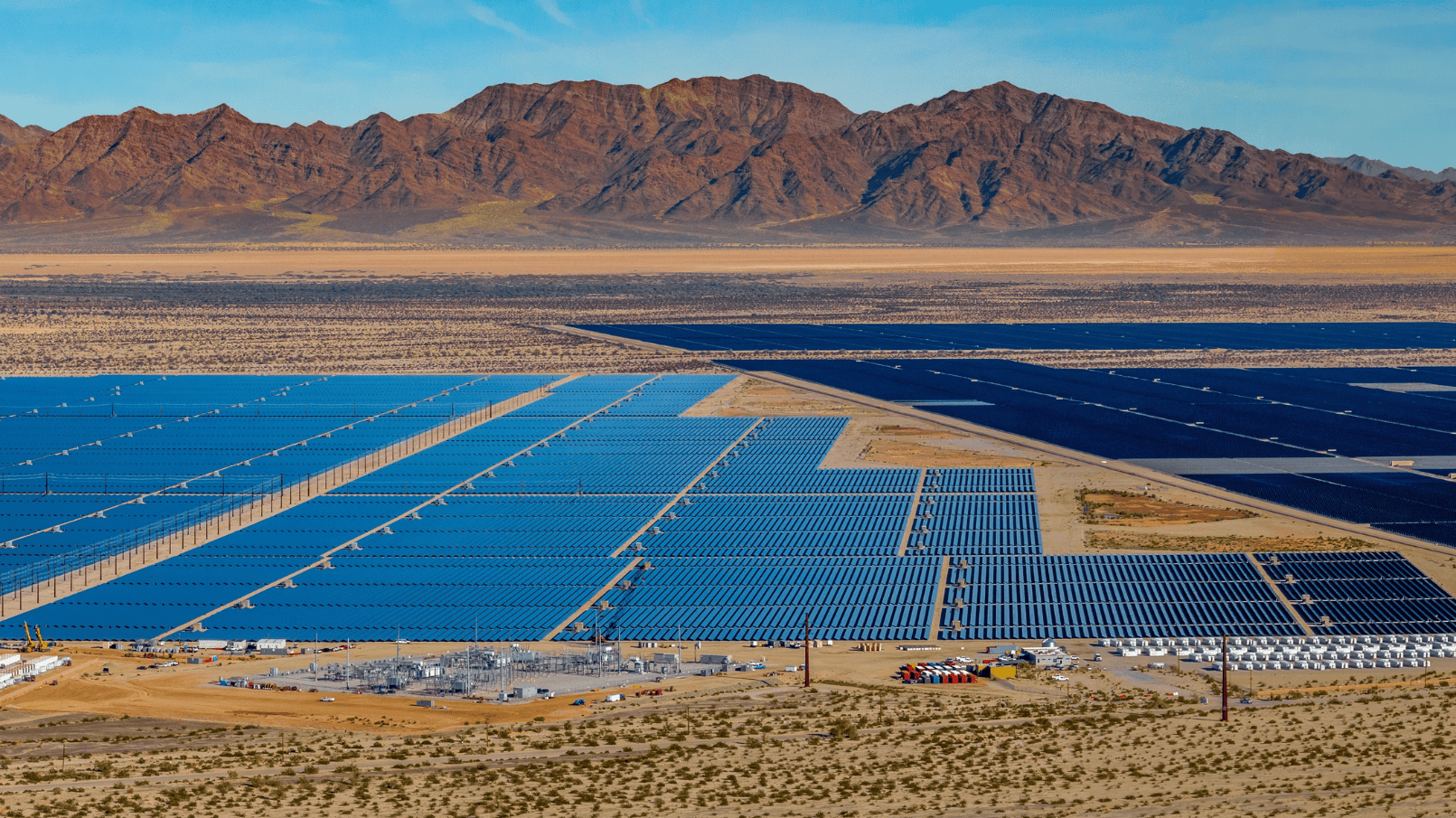

- Location: Flat land in areas with high sun exposure, favorable energy market pricing, and access to the electrical grid will yield higher returns for investors and landowners alike.

- Interconnection Cue: Connecting a solar system to the electrical grid can be expensive. There are long lines of interconnection applications at various substations throughout the electric system. It is important to consider a location that has a shorter cue in order to bring your project to fruition.

- Policies & Incentives: Some states offer better solar incentives, such as solar renewable energy credits (SRECS) that generate cash payments for solar energy production. Furthermore, certain municipalities have favorable zoning legislation that encourage solar project development, making investments more lucrative.

Does Your Land Meet The Criteria For A Lease?

If you are a farmer or landowner looking to participate in a solar project by leasing your open land, you should consider several factors to determine if a solar lease will be profitable. Before pursuing a solar land lease, landowners must determine whether their property meets the necessary requirements:

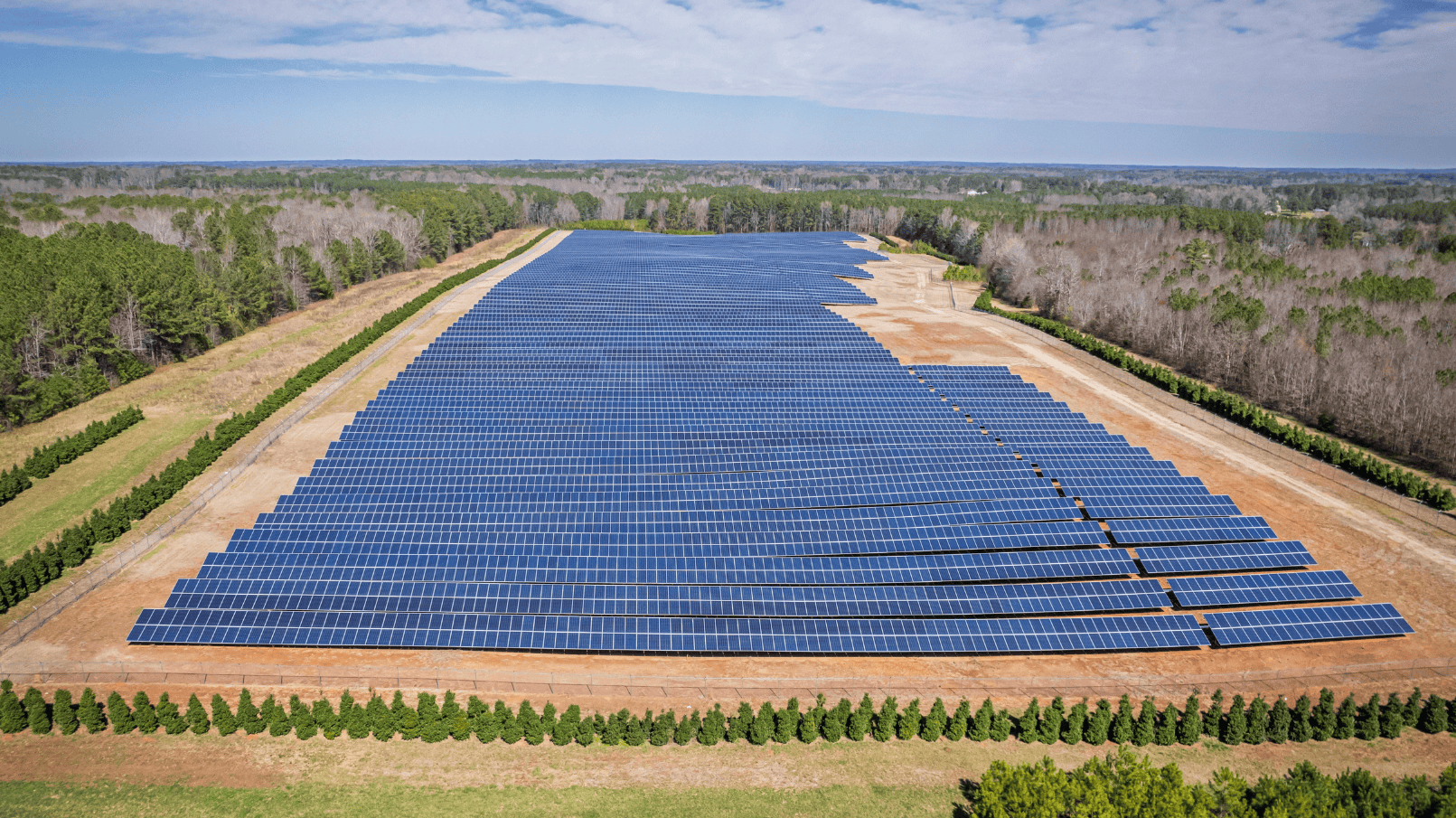

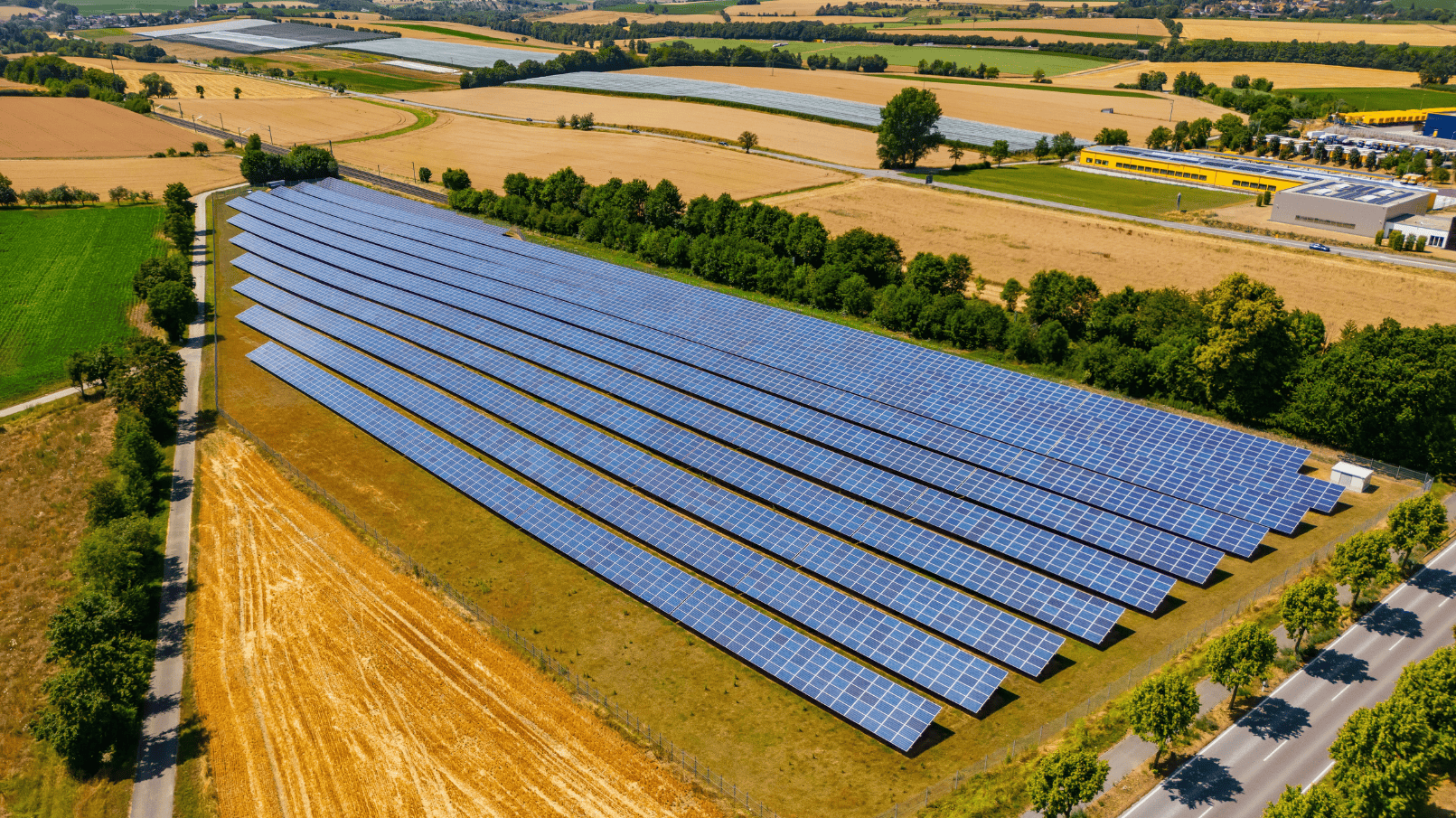

- Minimum Land Size: Most solar developers require at least 10–30 acres for a viable solar farm. You should evaluate your opportunity cost of leasing that amount of land.

- Zoning & Permitting: Local governments regulate solar project development, so zoning laws must allow for solar installations. A solar project can be delayed by years due to local ordinances and zoning pushback from residents.

- Soil & Topography: Land with stable soil conditions and minimal slope is ideal for supporting solar panel systems. You should also consider the cost-benefit of clearing trees or flattening hills on your property.

- Proximity To Three-Phase Power: Access to the electrical grid is critical for the economics of a solar farm project. Land that is too far from the proper electrical infrastructure drives up the cost of the project and makes the financials unfeasible. It’s paramount that your property is near a three-phase power transformer or substation.

- Deregulated Energy Markets: Property located in states with deregulated energy markets is more valuable for solar development. These markets allow solar asset owners lots of flexibility when it comes to selling the electricity generated by the solar system. They are able to participate in both wholesale and retail energy markets, as well as entering into virtual power purchase arrangements, such as community solar.

Landowners can get a complementary land evaluation from Genie Solar Energy to assess whether their land is a good fit for a solar investment.

Be Cautious Of These Risks

While investing in solar energy offers excellent financial opportunities, landowners and investors should be aware of potential challenges and risks associated with these projects.

1. Long-Term Commitment

- Solar leases typically last 20–30 years, so landowners must be comfortable with a long-term agreement and committing their land for the entire length of the term.

- Understanding lease terms and potential land restoration requirements is critical. Be sure that your lease agreement provides language for project decommissioning and land restoration.

2. Community Concerns

- Some communities may resist solar project development, citing aesthetic concerns or misinformation about solar energy systems. Landowners must be aware that they could face criticism in their local communities for participating in these projects.

- Developers should engage with stakeholders and local townships early in the project timeline to debunk solar objections and common misconceptions.

3. Upfront Costs

- The interconnection application and engineering processes can be lengthy and expensive, depending on grid conditions and transmission infrastructure upgrades. Investors should be aware of these costs as they are not recoupable.

- Proper planning and working with an experienced solar developer can help mitigate these issues. An experienced developer can accurately forecast a project’s viability prior to submitting interconnection applications or paying for engineering services.

Why Partner With Genie

Genie Solar Energy specializes in solar land leases, community solar projects, and utility-scale solar development. Backed by a publicly traded company, Genie offers transparent processes, expert guidance, and proven success in renewable energy investments. If you’re considering leasing land for solar panels or investing in a solar development, contact our team today for guidance. We can create Pro-Formas to forecast project profitability and evaluate unused land for lease potential.