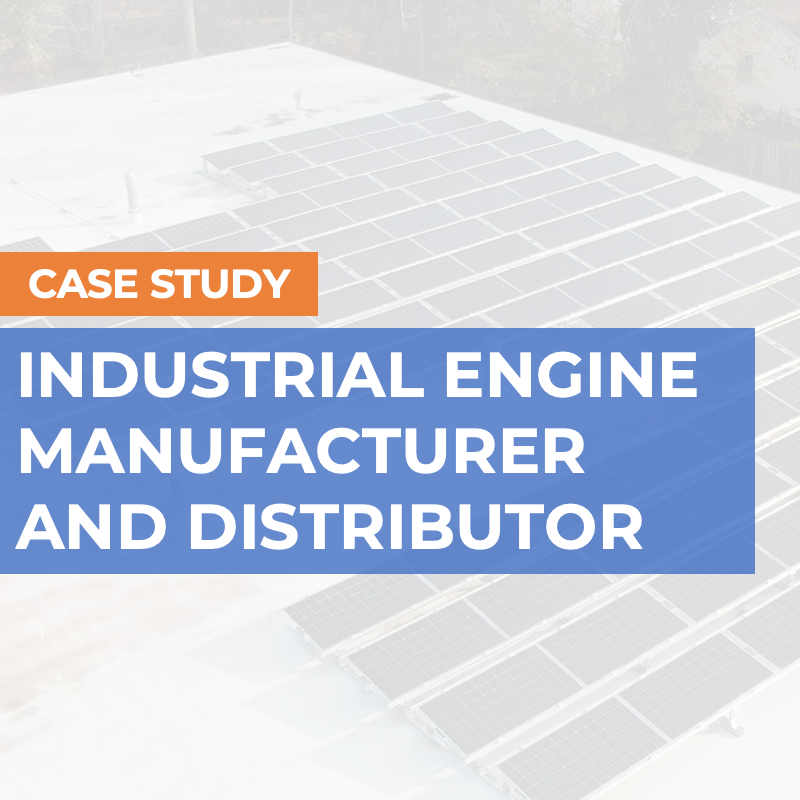

Government rebates and credits can impact your costs significantly. Local, state and federal tax incentives could potentially cover up to 50% or more of your overall system costs.

Businesses can take advantage of depreciation to accelerate their ROI on a solar system. The Tax Cut and Jobs Act of 2017 provides an option for 100% bonus depreciation. Solar has a scheduled depreciation recovery period of 5 years – so you can spread it over 5 years or take it all in year 1.

A business cannot depreciate 100% of the project cost. The Investment Tax Credit (ITC) reduces the bases of depreciation by one-half of the tax credit amount allowed. With the current ITC at 26%, it will reduce the depreciable basis to 87% of the total cost. Therefore if your system costs $100,000 you will be able to depreciate $87,000 of the cost. To calculate the value, you will multiply the basis by your federal income tax rate.

For larger systems, a tax equity partner may be willing to put in the funding for a portion of the project. There are many tax equity situations – speak to your Genie solar expert to see if your project would qualify for this solution.

Of course, all systems do not receive the same tax credits; all systems and products are not created equal. You should work with a solar expert AND your accountant to understand how solar will impact you.